Entertainment expenses - what are they? What can I Claim?

Now that we are in the final quarter of the year our thoughts typically turn to holiday celebrations.

For you, this may also mean considering whether the celebrations are tax deductible. Over the years many people have asked these kinds of questions - so here it is - Christmas Expenses - what is deductible and what is not!

As a general rule, if you provide entertainment for your team or clients, some of your business entertainment expenses are tax deductible.

Some examples of fully deductible entertainment expenses are food and drink:

- While travelling on business

- At promotions open to the public

- At certain conferences (to qualify for full deduction of the cost of food and drink the conference or course must continue for four hours or more, not counting meal breaks such as lunch and the principal purpose for the conference must not be entertainment.)

Some other entertainment expenses are only 50% deductible, for example:

- Taking a client out for a meal to discuss business

- Staff drinks in the office

- Staff Christmas party

If your entertainment expenses are only 50% deductible, you can only claim the deductible portion in your GST return.

Its worth remembering if employees (including shareholder-employees) enjoy entertainment benefits at their discretion and outside their normal employment duties, then these will be subject to FBT.

Record keeping

To support your claims for business entertainment expenses, keep your

- invoices and receipts,

- attaching a note recording the purpose of the expense,

- who was present and their relationship to your business.

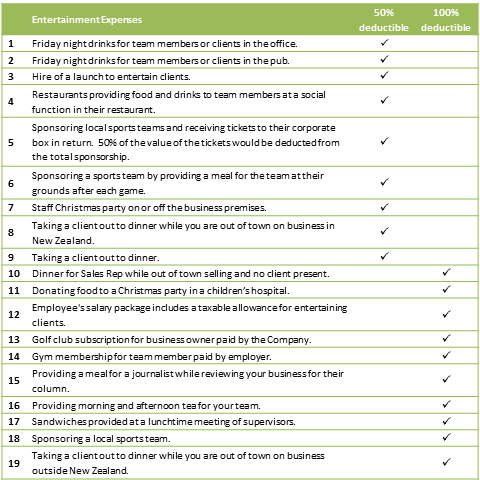

Entertainment expenses examples

The rules and exemptions are typically complex, so we have created an easy to read table with some of the more common types of expenses and their eligibility.

Our advice

As you can see the rules are complex. For big ticket items, or anything that you are in doubt about, give us a call, on 578 3386 or email us at askme@tva.co.nz, we're more than happy to help.

Brenda McInnes

Brenda McInnes heads TvA's Business Support team. The team covers daily administration for business owners, such as GST, Payroll, and ACC. If you have any questions related to your GST send email at support@tva.co.nz or contact Brenda on 03 578 3386.